We know you work hard while you’re out on assignment. That’s why we make getting paid for your locums work as easy as possible: so you can focus on providing care, instead of filling out more paperwork.

Our providers are treated as contract employees. That means you will receive your locum tenens salary directly from us, so you don’t have to worry about learning the ins and outs of each individual facility’s HR and payment processes. As part of your onboarding paperwork, we will ask you to fill out a W-9 and a Direct Deposit form (unless you prefer to be paid by check).

It’s important to remember that all locums providers are independent contractors. That means that state and federal income taxes are not taken out of your paycheck beforehand, so you’ll want to make sure to set money aside from your locums pay for your taxes. We recommend that you engage an accountant––they can help you set up quarterly tax payments so that you can get into a rhythm of paying your taxes regularly, instead of waiting until the end of the year.

By the time you go out on assignment, you will have received a confirmation detailing your schedule and your locum tenens pay rates. Then, once you’re out on assignment, you will be paid on a regular schedule through Hayes Locums.

Here’s how our locum process works to get you paid quickly and easily:

Submitting Your Hours

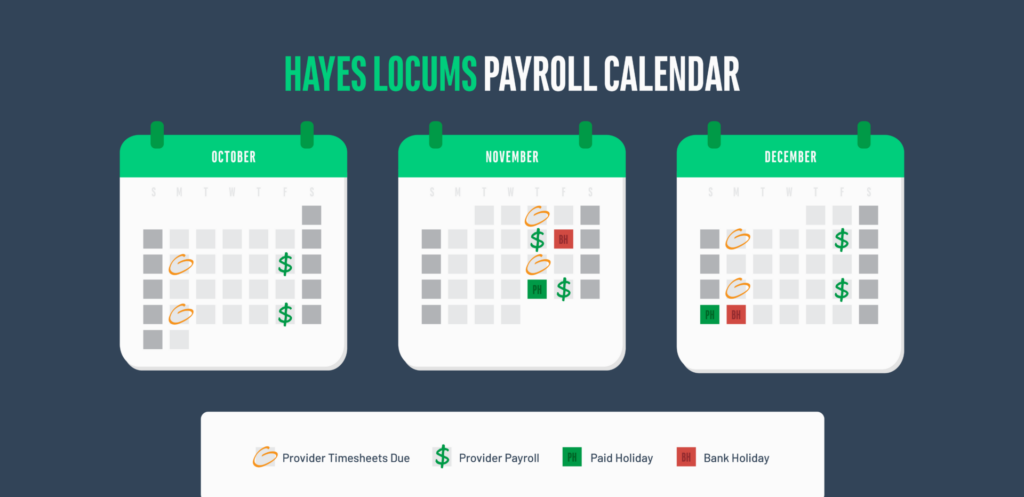

Providers are paid on a bi-weekly schedule. You will receive an email from your consultant with a link to your timesheet, along with a deadline for when to submit it. Timesheets are due every other Monday, pending holidays.

To save you time and effort, we pre-fill as much information as possible, so you can submit it quickly and easily.

The timesheet is pre-populated with the appropriate rate types. Depending on the type of shift you worked, you may have to input hours for different rate types, e.g. clinic hours vs. on call hours––as well as the rate itself, so all you have to do is fill out the actual hours you worked during that time period.

Approving Your Timesheet

Once we receive your completed timesheet, we send it to the facility for approval. After the hospital approves your hours, we will process your payment that same Friday.

In general, it’s a good idea to submit your timesheets as early as possible, so we have plenty of time to get approval from the facility. While we will always pay your base rate regardless of whether we receive approval back by the deadline, hospital approval is required before paying out any overtime hours.

We handle any and all back-and-forth between the facility, so you don’t have to worry about anything except for filling out your hours.

Applying for Reimbursement

While our travel team is responsible for purchasing your flight, rental car, and hotel reservations, we also offer reimbursements for certain types of travel expenses. These reimbursements are non-taxable, so they will not count towards your taxable income.

If you are flying to your assignment, we will reimburse you for any transportation expenses to and from the airport, as well as airport parking and any baggage fees. If you are driving, we will either reimburse you for mileage (if you are driving your own car), or gas (if you are driving a rental car), as well as any tolls.

Beyond just reimbursements, we always recommend that you keep track of any expenses related to your assignment, so that when tax time rolls around, you have all of the information you need for your locum tenens taxes ready to go.

As always, if you have questions along the way, your consultant is there to help: whether you need help submitting your timesheet or uploading receipts, or if you want help understanding how recent compensation trends might affect your rates. We are there to support you through every step of the locums journey, from first contact to your final payment.

Introducing the Hayes Handbook: Your Locum Tenens Guide

See how our team supports you through every stage of the locum tenens process. Start reading.